One-step-ahead investments

have found the best ones

with $10

from shares

of 20-80% per year

Our investment ideas

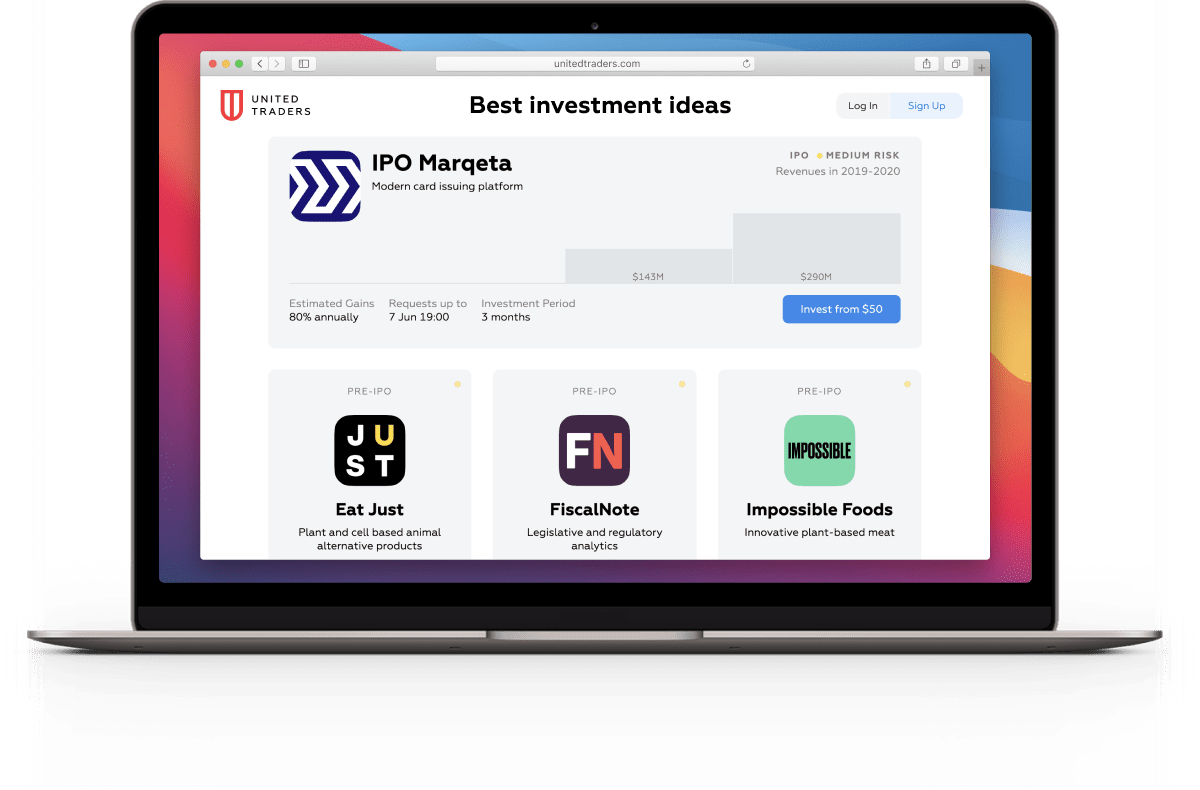

IPO means initial public offering. When a company goes public, the demand for its shares and price go up, and investors can profit from this growth.

We offer you to buy shares a few days before IPO and sell them three months later.

The chart shows how your portfolio grows if you invest in every IPO we offer.

Pre-IPO is a growing secondary market. We offer shares of companies before they are actually publicly traded in exchanges, but plan to go public soon. Investment horizon is 1-2 years.

The chart shows the value growth:

- 40 private companies in UT's portfolio

- 500 largest publicly traded U.S. companies

Overall, young private companies grow at a faster pace than major publicly traded ones.

SPAC

SPACs are not operating companies. Their main goal is to transition a company from a private company to a publicly traded company through a merger or acquisition, rather than a traditional IPO. The average investment period is six months.

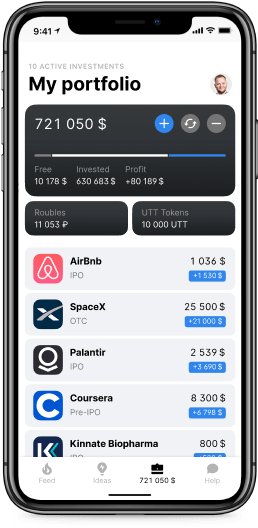

Stocks and ETF

Traditional instruments on the public market. Better-suited for advanced investors seeking to balance their portfolio. You can select from more than 1,000 securities to invest.